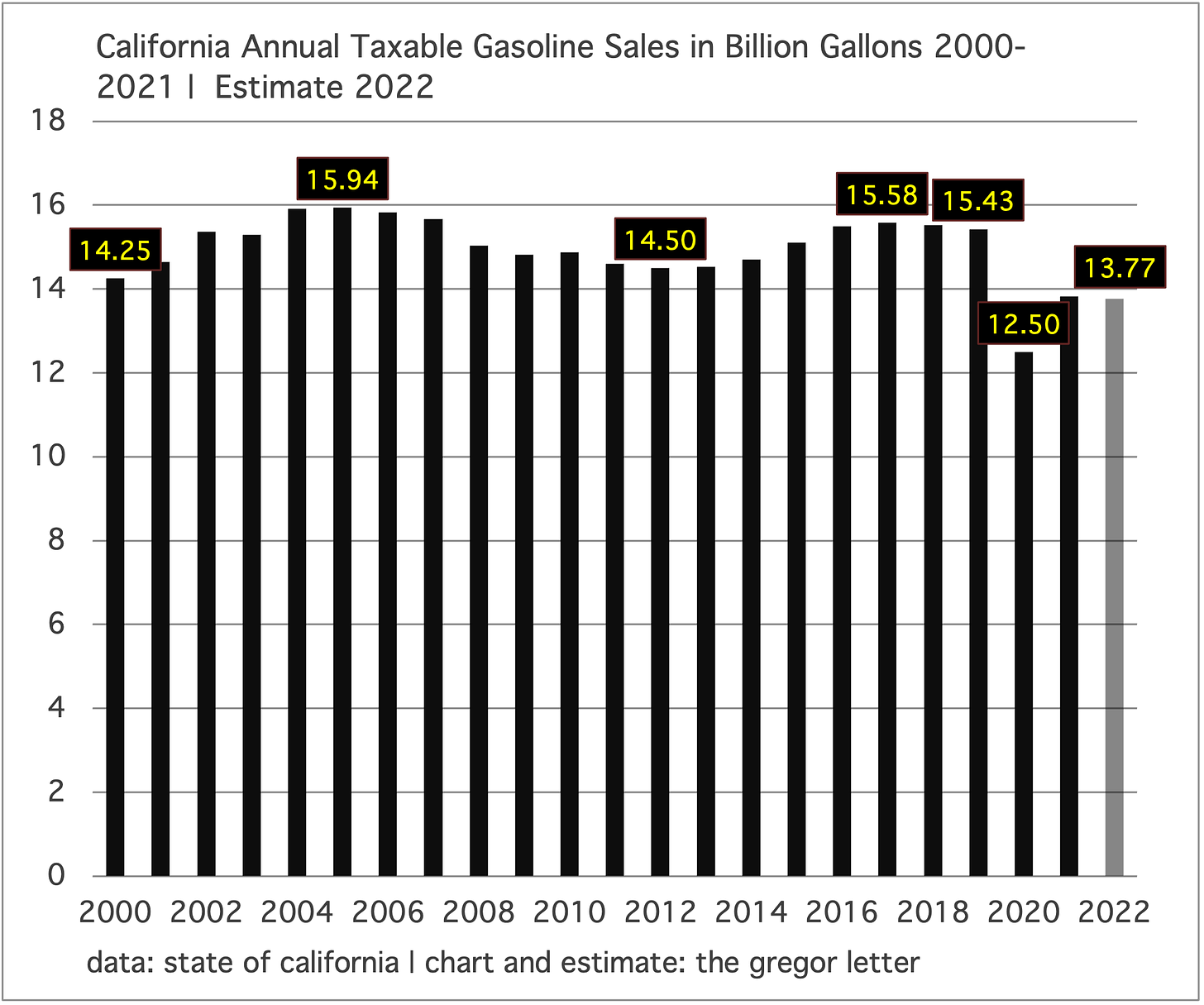

After a long plateau going back twenty years, California gasoline consumption has finally entered decline. The turning point likely offers lessons to other domains, also seeking to kick petrol consumption into decline, or, trying to figure out why doing so is hard. California’s population grew a full 10% from 36 million to 40 million over the ten year period from 2010 to 2020. And the state’s tech-led economy boomed during that time, creating budgetary surpluses. But phased-in gasoline taxes, incentives for purchasers of EV, disincentives for ICE ownership, and a buildout of public transportation eventually produced moderate traction against fuel consumption. The final shove down the stairs came of course from the pandemic. California is unsurprisingly ground zero for the type of flex-work typical within tech companies, and the Golden State embraced work-from-home enthusiastically. Even if you price in a mean reversion to office work, there will likely be a remainder of workers—at least 10% to 15% of the state’s workforce—that adopt flex arrangements permanently.

The turning point brings resolution to a long, historical arc that began nearly a century ago, as fast population growth and cities built around the automobile flourished in the American west, not just Los Angeles. Petrol consumption advanced with few interruptions. Within California, only San Francisco, really, existed as a pre-automobile city having developed originally during the Gold Rush and the Victorian eras. Southern California by contrast would become the American epicenter of a different kind of city, one anchored by suburbs at the core, rather than suburbs on the periphery. Indeed, L.A. was originally marketed on a plan that promised single family home ownership within the city, replete with a yard and a driveway. As a marker for the central place parking itself enjoyed in California planning history, it was not until this year 2022 that the state made significant changes, reducing mandates to developers—freeing them to build residential capacity without parking spaces. And it should be mentioned, apartment and condo building has been robust in Los Angeles in the past decade, and a new, younger group of people have increasingly attempted to make a life in the city without a car.

Perhaps the most intriguing long term outcome from the decline will arrive in the form of reduced petrol tax revenue to the state. The other side of the ledger in California’s car culture has meant, for a very long time, tidal waves of growing tax revenues from petrol sales. And when the state began to contemplate higher petrol taxes, it modeled that eventually gas tax revenues would decline. The boosted gas tax regime was in fact part of a mitigation plan that would give the state a kind of running start, before gas tax revenues finally turned down. Going forward, California will need to be creative in how it manages its vast network of highways, or really, the punishing cost of maintaining them, as the EV era unfolds and comes to dominate the state’s vehicle fleet. One possibility: the state moving to a VMT tax (vehicles miles traveled).

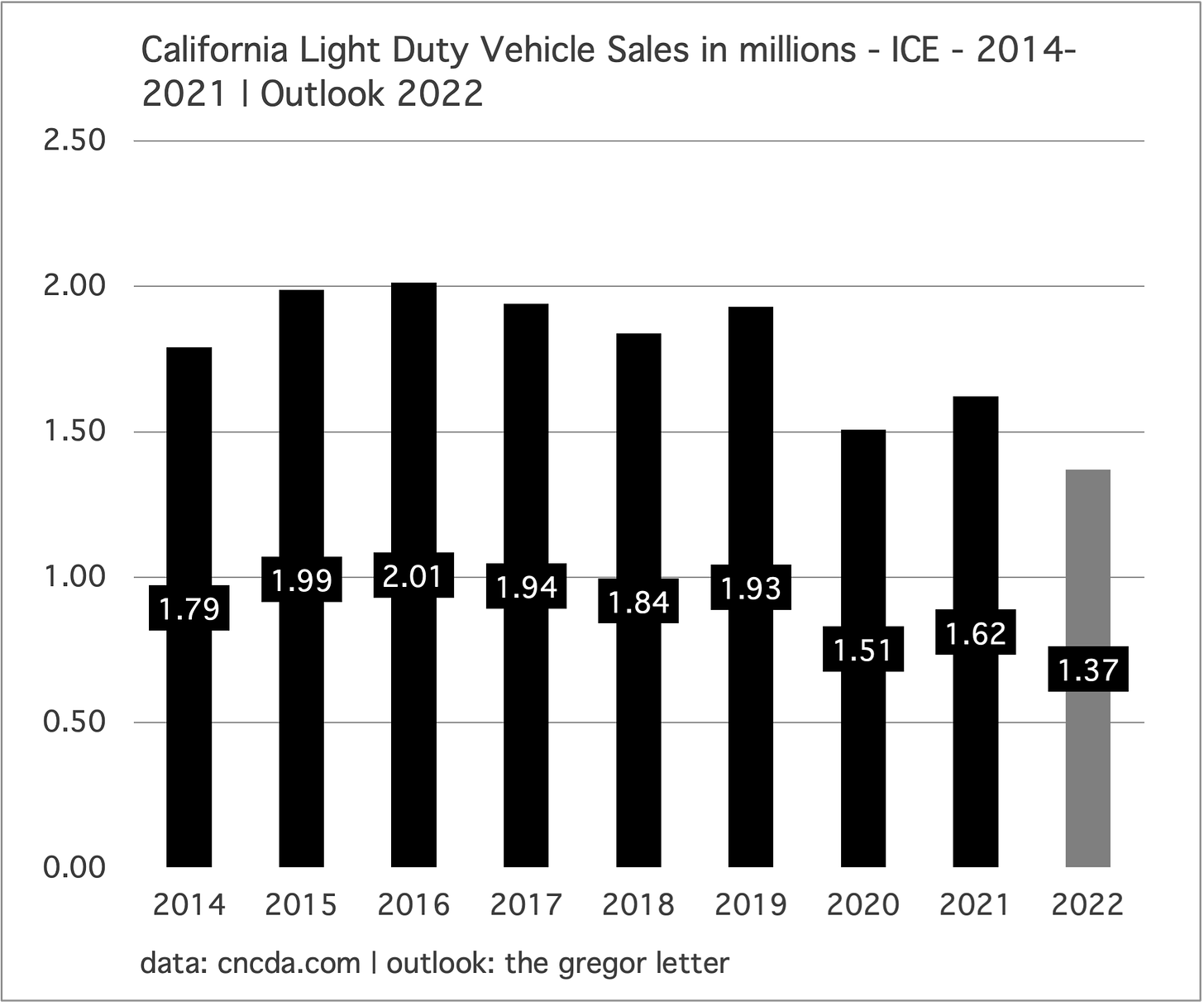

The peak in ICE sales, now anchored to the year 2016 via quickly advancing sales of EV, is now a key part of the state’s petrol trajectory. On the chart below, you can see the decline and how it’s proceeding. ICE sales are on course to be down 32% from the peak through the end of this year.

From a total fleet perspective, the aggregate plug-in count still looks quite small, and had only reached over 800,000 on-road units by the end of 2021, in a total state fleet of over 30,000,000. What’s important to recognize here, however, is that combined with all the other factors, including small net outward migration of the population (California lost a congressional seat in the 2020 census), the state stopped adding to its ICE fleet years ago. Hence, there is simply no growth driver for higher levels of gasoline consumption. Now consider that plug-in sales will nearly reach 19% share of the market this year (315,000 plug-in units in a 1,700,000 total market) and you can see how a drag, and now a decline, would set in on the state’s petrol demand.

But the decline will not be rapid, and will not be steep.

EV adoption alone will not produce road fuel demand declines in any domain, absent other contributing factors, until market share gets to much higher levels. The existing ICE fleet always looms as a kind of expansionary, or contractionary, force on petrol demand depending on booms and busts in the economy, and yes, on rare factors like a pandemic which leads to a change in workplace commuting. All that said, the hurdles to a resumed growth phase in California gasoline demand are many, and imposing.

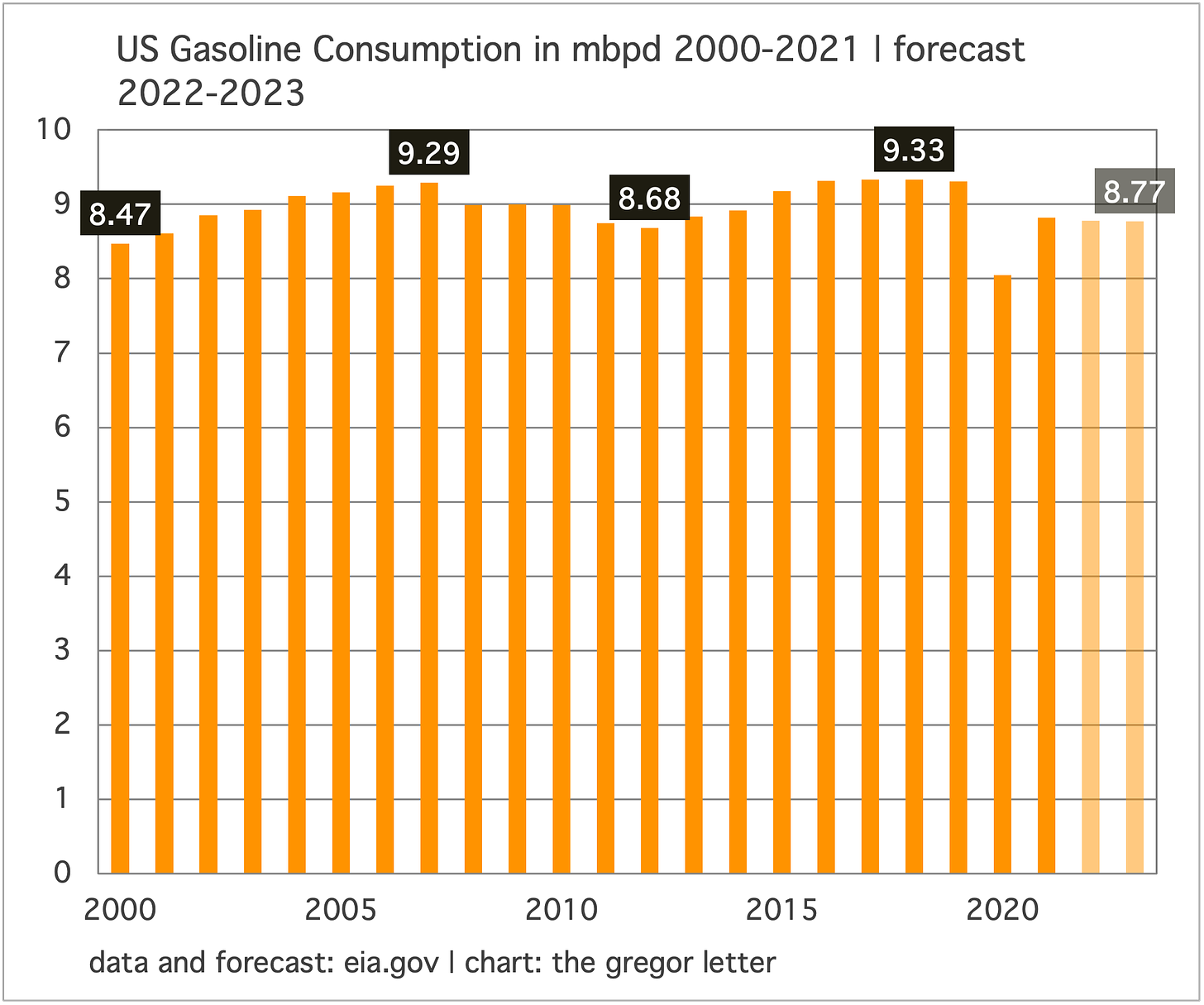

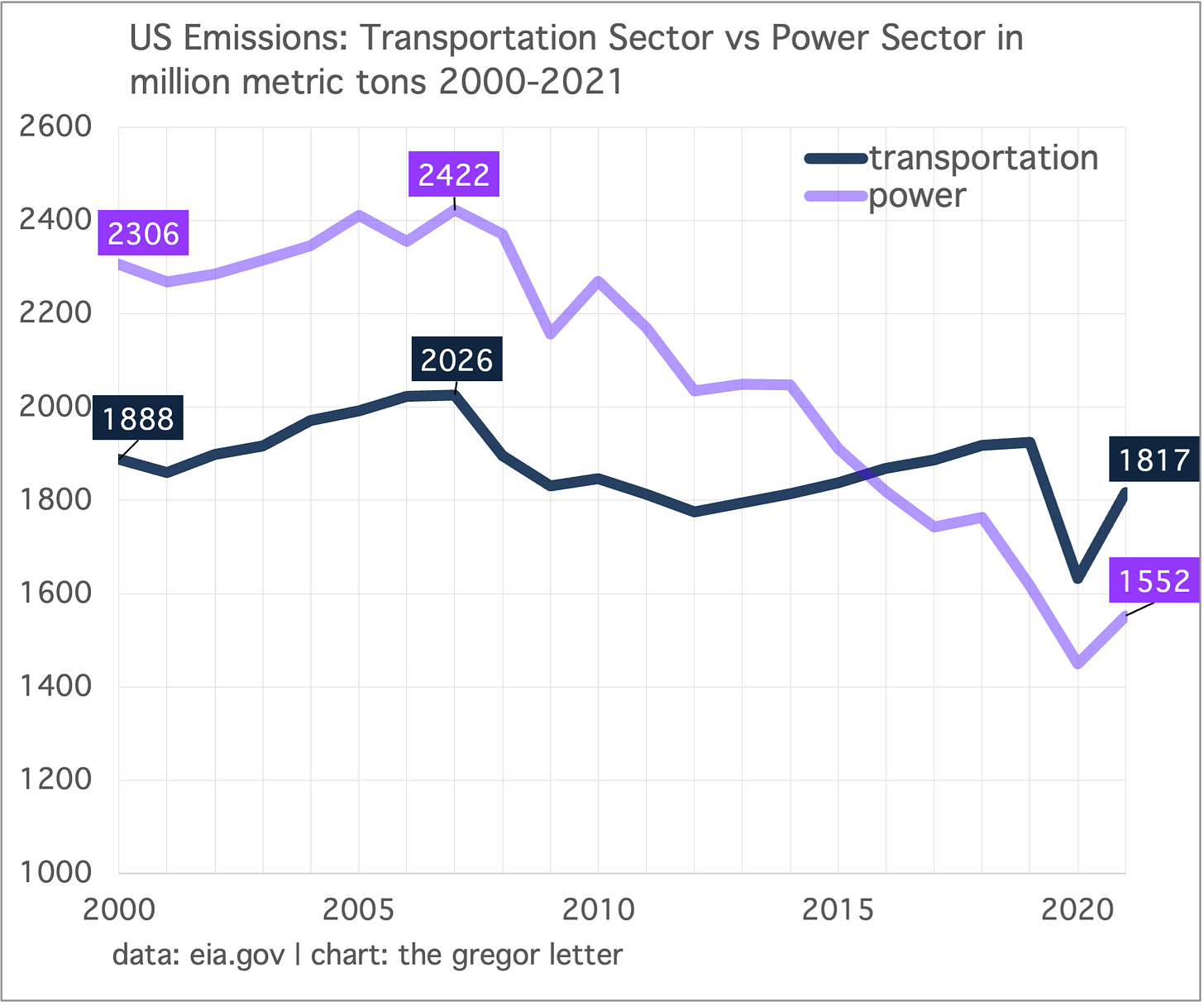

A broader question: could California lead the rest of the US into a national decline in gasoline consumption? Maybe, but best not to count on that outcome for a while. Yes, the rest of the US has also been transformed by the pandemic. But the US as a whole does very little, if nothing, to attack the existing ICE fleet because gas taxes, car taxes, road taxes, or congestion taxes are a third rail in US politics. Yes, the chart below suggests we could fall off the long plateau. But without far better, faster EV adoption and policies that seek to dislodge discretionary travel, the best one could expect here is a step down to a slightly lower plateau.

And a final point: the US has harvested enormous emissions reduction gains in the national powergrid the past decade through the mass retirement of coal, and the buildout of wind and solar. From this point forward, however, emissions reductions are going to be less easy to secure. Transportation, not electricity, now accounts for the majority of US emissions. EVs by themselves are not enough. Yet, the transportation sector remains an area of extreme underfocus in the US climate effort.

US interest rates are falling again as it becomes clear that inflation has now peaked and the Fed’s tightening cycle is coming to an end. The inflection puts to rest emerging fears that the economy, and infrastructure buildouts in particular, would have to face a new regime of persistently high interest rates. In classic fashion, the US Dollar Index has also been falling after screaming higher all year—another confirmation of the turn in rates, and the imminent end to rate hikes. As a result, markets have a new uncertainty to obsess over: a slowdown in the economy, and maybe a recession.

The dangerous encounter with inflation has left scars however, converting non-believers to a view that seemed unthinkable over the past several decades: that inflation would be sticky, here to stay. What many failed to appreciate however is that the big wheel of disinflationary pressure has been turning for a long time, and the small wheel of inflation that showed up in the pandemic’s wake was almost certainly an outcome of that crisis, and not a regime change from the long term trend. The Gregor Letter suggested during summer that inflation had peaked, but angrily hawkish actions and words from the Federal Reserve thwarted the decline in interest rates. Now we know however that inflation did, roughly, peak in summer. The initial interest rate move lower was the right one. And a larger decline was merely deferred. That may be why the current move lower is looking stronger, and swifter.

Just to remind that energy transition in the long term is deflationary, if not massively deflationary. In the near term, the transition does however place upward pressure on resources prices. But much of that configuration is due to the intrinsic quality of renewables. Large upfront capital expenditure costs are required to deploy clean energy, but then operational expenditures fall dramatically thereafter.

Hydrogen faces two hurdles on its way to broader adoption in industry. First, technology and the learning curve need to find an affordable way to produce hydrogen from clean electricity through electrolysis. Second, starting from a low point, the world will need to build hydrogen supply networks that have reach. The challenge in production economics largely can be found in the cost of electrolysis; in particular, the electrolyzer itself, a large and very costly piece of equipment. As many will understand, the more hours you can run an expensive piece of capital equipment, the better your return. A week contains 168 hours. If you can utilize all or nearly all of those hours, rather than just half, ROI is transformed. And that’s why nuclear, rather than wind and solar, merits serious consideration as a way to drive electrolysis at scale.

Portland based NuScale Power, along with Shell Global Solutions, is looking to do just that by pairing a modular reactor to electrolysis. Encouraging, yes. But it’s worth remembering that many projects in the hydrogen space are at the demonstrator stage of development, where words like concept, prototype, and simulation still dominate. Using NuScale as an example, their design for a small, modular reactor (SMR) has been making its way through an approval process at the NRC. But the process is slow, very slow.

Further reading: When It Comes to Nuclear Power, Could Smaller Be Better?

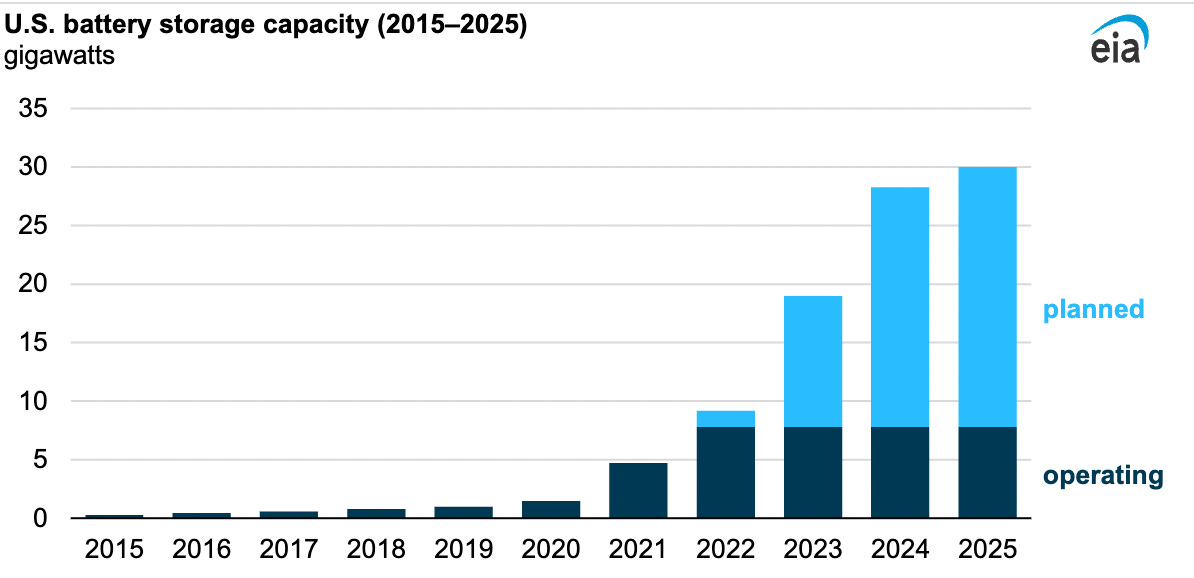

The growth rate of US utility-scale battery storage capacity is outpacing the early growth rates seen in utility scale solar. That’s according to a new EIA outlook on grid-level storage:

The remarkable growth in U.S. battery storage capacity is outpacing even the early growth of the country’s utility-scale solar capacity. U.S. solar capacity began expanding in 2010 and grew from less than 1.0 GW in 2010 to 13.7 GW in 2015. In comparison, we expect battery storage to increase from 1.5 GW in 2020 to 30.0 GW in 2025. Much like solar power, growth in battery storage would change the U.S. electric generating portfolio.

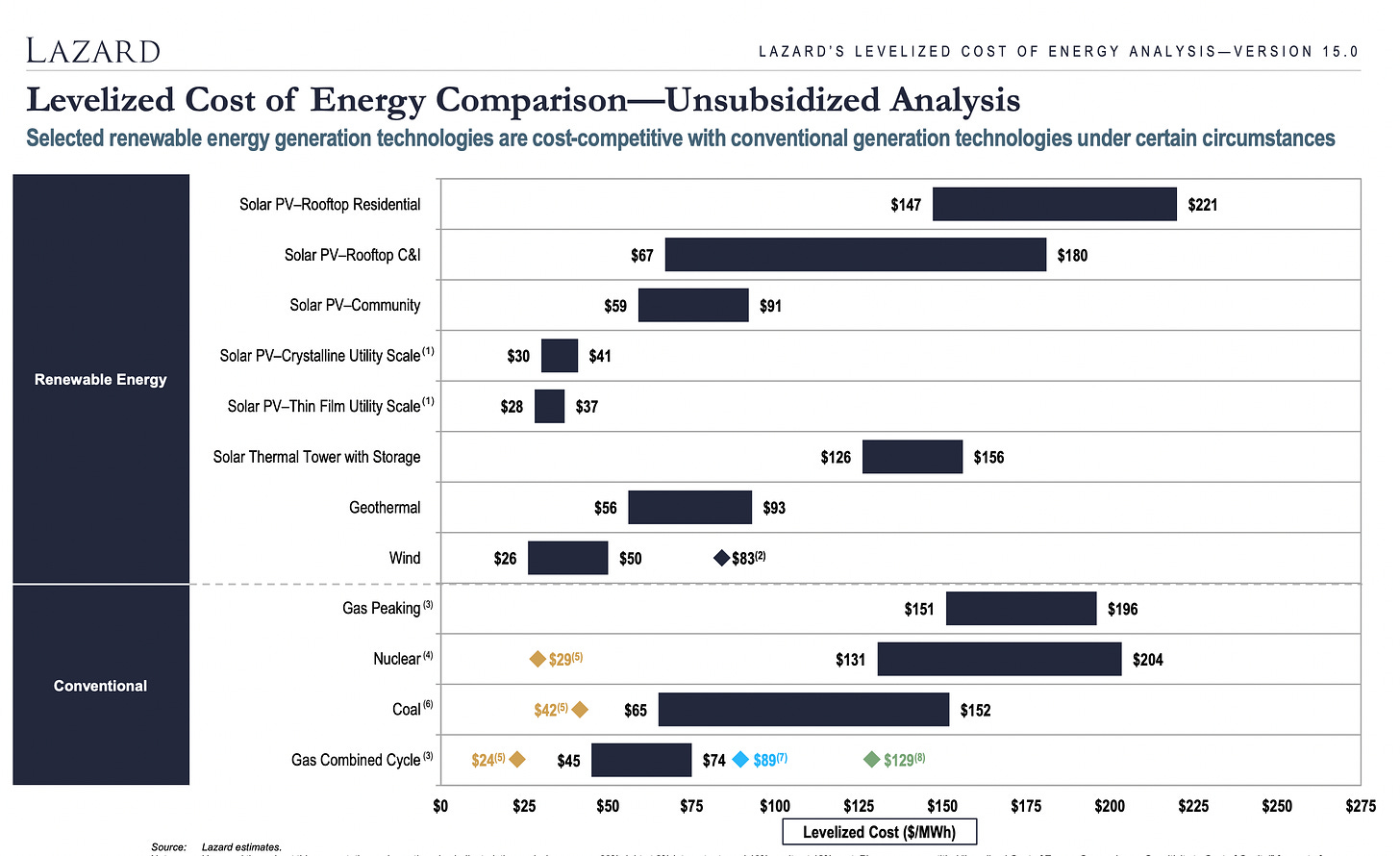

As The Gregor Letter has pointed out for years, the rapidly falling costs of wind, and solar especially, have now made renewable power a cheap commodity. Starting years ago, this implied that despite the slower decline in costs for battery storage, that whole system costs would come down regardless. In other words, solar got so cheap that it made the economic prospect of adding “expensive” storage increasingly workable. And now that is the new reality. Indeed, it’s now routine to pair storage with most new wind and solar projects.

Just to illustrate, the below chart from Lazard’s LCOE analysis (Version 15.0, 2021) shows just how cheap both wind and solar have become. For those not familiar, the levelized cost of energy analysis is an all-in approach that considers everything from construction and financing to operational expenditures and lifespan. For example, in the chart below showing unsubsidized LCOE, note that only existing, fully depreciated natural gas power (in gold, see original PDF for footnotes) can compete with new wind, and new solar. New natural gas? Nope. But new wind and solar + storage is probably at the current line of scrimmage with new natural gas. The former comes in around $28-$30/MWh without storage, and the latter comes in around $45-$74/MWh. But the natural gas has higher value to the grid compared to wind and solar when they’re not paired with storage. That’s why storage is the death blow for fossil fuel in power.

OpenAI, a San Francisco based company, released its latest chatbot to the delight of many, and consternation of others. Possessing an array of capabilities, and based on the lightest of prompts, ChatGPT is able to write a competent, short essay on just about any subject; can be used to create a virtual machine, and can help programmers debug code. Wharton professor Ethan Mollick introduced it to his class, with the result that one of his students used it to quickly create a working demo of a product. Bloomberg journalist Tom Randall used it to save an hour’s worth of work.

Unsurprisingly, the big picture view of OpenAI’s progress in this area (and by the way, OpenAI is expected to keep releasing continually better interactive AI interfaces) is that this all represents a potential productivity breakthrough. Former Treasury Secretary Larry Summers can’t stop talking about this exact potential. In a Wall Street Week interview, he compared ChatGPT to the kinds of general purpose technologies that transformed human prospects, on par with the printing press or electricity, and maybe even the wheel, or fire.

There are downsides. Many wondered if ChatGPT essentially means that end of the high school and college essay (Personal note: my own high school student, a junior, presented to the AP English teacher an essay written entirely by ChatGPT. Not bad, was the initial response. And then, as a responsible student, revealed the hat trick. To which the teacher responded, ok, use what the AI produced like you would research to write your own essay). But not all students will be as forthcoming. That’s why venture capitalist and writer Paul Kedrosky suggested that ChatGPT and its future iterations could trigger a collapse of trust.

For our purposes, this is a good time to remember that energy transition mostly means electrification, and electrification fits beautifully with digitization, and software. That’s why the interoperability of home and car batteries with power supply is already optimized, as will be the case on the grid level as well. Perfection of wind and sun capture by existing arrays will also increase as automation reaches installations, solar panels turning incrementally like plants, towards the sun. Through software, what is seen as an intrinsic flaw of renewables—their intermittency—is potentially a strength when combined with storage.

If you have not yet tried out ChatGPT, you can do so here.

I asked the chatbot to write a sonnet about energy transition, the rise of wind and solar and the death of oil and coal. The result is fairly pedestrian, but says alot about potential.

—Gregor Macdonald

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the 2018 single title is newly packaged and now arrives with a final installment: the 2023 update, Electric Candyland. Just hit the picture below to be taken to Dropbox Shop.